georgia ad valorem tax motorcycle

Legislation enacted by the Georgia General Assembly in 2012 created a new system for taxing motor vehicles registered in Georgia. Eservicesdrivesgagov If instead you intend to take delivery and keep the vehicle in Tennessee beyond the three-day-period you must pay the appropriate Tennessee sales tax.

Georgia Motor Vehicle Ad Valorem Assessment Manual

TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles.

. Ad valorem tax which varies depending on your motorcycles purchase price. 80 plus applicable ad valorem tax. 2012 Black Cross Country.

Casual sale Title Ad Valorem Tax penalty for not submitting. Annual Special Tag Fee. Registration Fees Taxes.

In the States that have to pay Ad Valorem tax when you buy your tags is it set at a reasonable price or is it like a luxuary tax. Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax and the annual ad valorem tax. Contact your local County Tag Office for details.

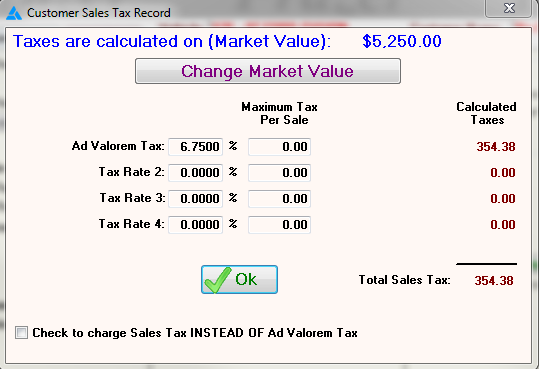

TAVT is calculated at fair market value multiplied by the TAVT rate which is currently 66If you wish to dispute the assessed value of your vehicle you may. NOTE This guide is for the annual ad valorem tax. Ad Valorem Tax Required.

You can determine the TAVT amount at the following link. Submit the above either in person or by mail to your local county tag office. In Georgia my 07 Ultra far exceeds the Ad Valorem tax cost of my wifes Caddy or my F-150 crew.

Uniform tax valuations used in calculating Title Ad Valorem Tax TAVT and motor vehicle ad valorem taxes are certified to county tax commissioners by the Georgia Department of Revenue. Title Ad Valorem Tax TAVT The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. Our Motor Vehicle Division bills collects and distributes ad valorem property taxes or title ad valorem taxes for motor vehicles trailers motor homes motorcyclesscooters and tractor trailers under IRP.

The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties. The tax must be paid at the time of sale by Georgia residents or within six months of. Only one tag issued.

Georgia Ad Valorem tax Discussion in Victory General Discussion started by Bobbyd85 Jan 14 2015. NOTE This guide is for the annual ad valorem tax. Of the Initial 80 fees collected for the issuance of these tags the fees shall be distributed as follows.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. It replaced sales tax and annual ad valorem tax annual motor vehicle tax and is paid every time vehicle ownership is transferred. Payment for the 20 registration fee plus any other applicable taxes and fees.

20 Annual License Reg. Get the estimated TAVT tax based on the value of the vehicle using. Are you paying a lot for this tax in your State.

For the Title Ad Valorem Tax TAVT use the 2013 TAVT Assessment Manual. Your Georgia drivers license or ID. This tax is based on the value of the vehicle.

Valid drivers license or picture ID. Yes if applicable. 2500 manufacturing fee one-time fee 2000 annual registration fee.

Cost to renew annually. If you are registering during the registration period for that vehicle you will need to pay the ad valorem tax due at this time. 2000 annual registration fee.

GDVS personnel will assist veterans in obtaining the necessary documentation for filing. For the Title Ad Valorem Tax TAVT use the 2015 TAVT Assessment Manual. 2500 one time fee Annual Registration Fee.

The actual filing of documents is the veterans responsibility. Jan 14 2015 1. The Ultra tax this year is 179 and change.

Ad Valorem Taxes If applicable no exemptions on additional tags. Ad valorem Penalty has a 500 minimum. Fee 1 to the County Tag Agent 59 to State of Georgia General Treasury Annual Renewal.

MV-9W Please refer to this form for detailed instructions and requirements. For Georgia car leases the new one-time TAVT means no separate sales tax on down payment no sales tax on monthly lease payments and no more annual ad. In addition this division also operates as a tag agent on behalf of the Georgia Department of RevenueAs such they enforce state and local laws regarding vehicle.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. As a result the annual vehicle ad valorem tax sometimes called the birthday. The Commissioner of the Georgia Department of Revenue is charged by law with the annual.

Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia. 2015 Vehicle Valuation Manual Registration Ad Valorem Tax DO NOT USE for TAVT iii. 18 title fee and 10 fees for late registration.

Jul 26 2012 Messages. Do I have to pay the Georgia ad valorem tax on a leased vehicle. 5 of TAVT due after day 30 and 5 additional every month thereafter.

2013 Vehicle Valuation Manual Registration Ad Valorem Tax iii. Only one additional plate issued. Ad Valorem Taxes If applicable Cost to renew additional plate.

5500 plus applicable ad valorem tax. 393 Type of Motorcycle Currently Riding. US Army Ranger Motorcycle.

This includes an annual registration and tag fee of twenty dollars an ad Valorem tax sales tax and a title fee of eighteen dollars. Payment of the TAVT provides an exemption from sales tax on the motor vehicle and the purchaser will also be exempt from the annual ad valorem tax or. Motorcycles may be subject to the following fees for registration and renewals.

Questions Answers on Georgia Title Ad Valorem Tax TAVT Why is the system for paying my annual vehicle ad valorem taxes changing. New Plate Demo Page. Anybody registered a 2012 or 2013 victory in Georgia brought in from another.

At that time a one-time Title Ad Valorem Tax TAVT must be paid based on the value of the vehicle. 10 of Ad Valorem Tax due 25 of License Plate Fees. Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle.

Cost of additional plate. Dealer Title Ad Valorem Tax penalty for not submitting TAVT within 30 days of purchase. Georgia requires minimum-liability insurance on all motor vehicles.

TAVT is a one-time tax that is paid at the time the vehicle is titled. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Ad Valorem Tax on Vehicles.

Georgia Department of Revenue gives in depth information on the exact required amount of fee particularly the amount you have to pay as an ad valorem tax which is based on the current market value of your motorcycle. Title Ad Valorem Tax TAVT became effective on March 1 2013. Title Ad Valorem Tax Estimator calculator Get the estimated TAVT tax based on the value of the.

The Commissioner of the Georgia Department of Revenue is charged by law with the annual. Proof of Georgia motorcycle insurance.

Frazer Software For The Used Car Dealer State Specific Information Georgia

T146 Fill Online Printable Fillable Blank Pdffiller

2021 Property Tax Bills Sent Out Cobb County Georgia

The New Title Ad Valorem Tax Tavt In Simple Terms Lake Lanier

Georgia Used Car Sales Tax Fees

Vehicle Taxes Dekalb Tax Commissioner